Overview

Small business owners rely on cash flow to keep their businesses running. When they accept online payments through FreshBooks, the funds typically go through standard processing periods—sometimes taking days. For many small business owners, waiting that long can create financial stress.

Instant Payouts solves this by allowing business owners to access their funds immediately after a customer pays, with transparent upfront pricing. This feature has become a powerful tool for improving cash flow visibility and is a significant revenue driver for FreshBooks.

Project Details

Company: FreshBooks

Timeline: 2021 - Present

Role: Product Designer

Team: Design, Engineering, Product, Payments

The Problem

Through customer research, we discovered two critical pain points:

- Lack of Visibility: Business owners had no clear understanding of where their money was in the payment processing pipeline. This uncertainty created anxiety about cash flow and often resulted in owners reaching out to support to learn more.

- Processing Delays: Standard payment processing times meant business owners had to wait days to access funds and weren't able to receive funds on weekends. This was creating cash flow constraints for small businesses operating on tight margins.

For a small business owner, even a 2-3 day delay can be problematic when they need cash to pay suppliers or employees immediately.

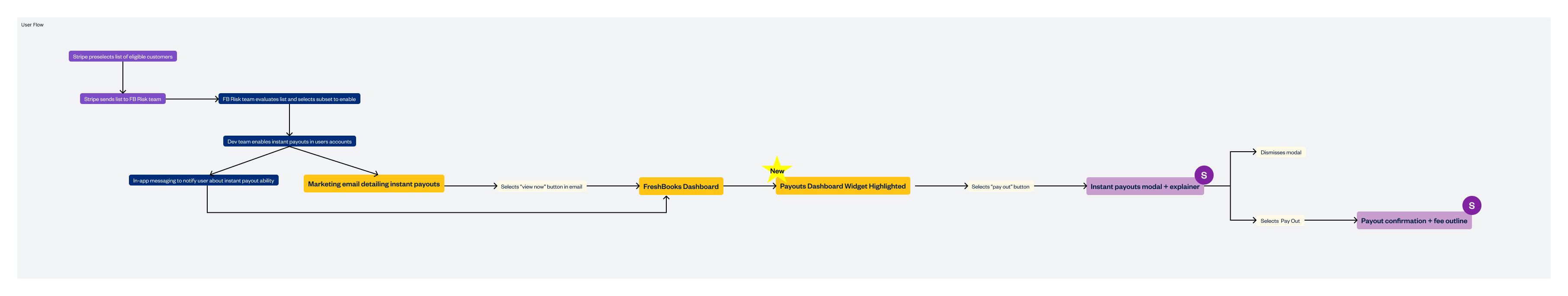

Initial user flow.

The Opportunity

FreshBooks could offer instant access to funds—getting money to business owners immediately. As well as provide more transparency around the payment processing flow. However, this comes with risk: Owners may be upset when they realize this costs additional fees. We needed to build a feature that was:

- Completely transparent about costs

- Crystal clear about exactly how much money they'd receive after fees

- Easy to understand at a glance

Why transparency was critical: We were dealing with customers' money. Any confusion about fees or final amounts could erode trust and create support headaches. We needed users to feel confident and informed with every payout.

Design Approach

The design needed to accomplish multiple things:

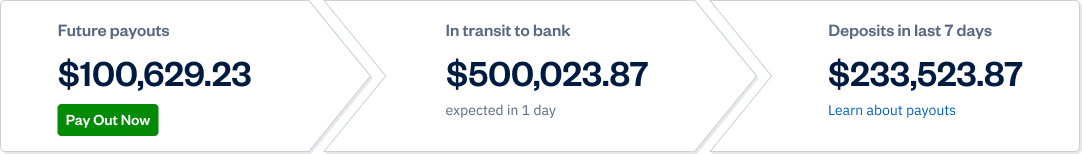

Show Payment Status & Journey

Create a clear visual representation of where money is in the processing pipeline—pending, in transit, or deposited. This visibility alone reduces user anxiety.

Make the Payout Action Clear

When a payout is available, it should be obvious and actionable. Users should know exactly when they can take action and what will happen.

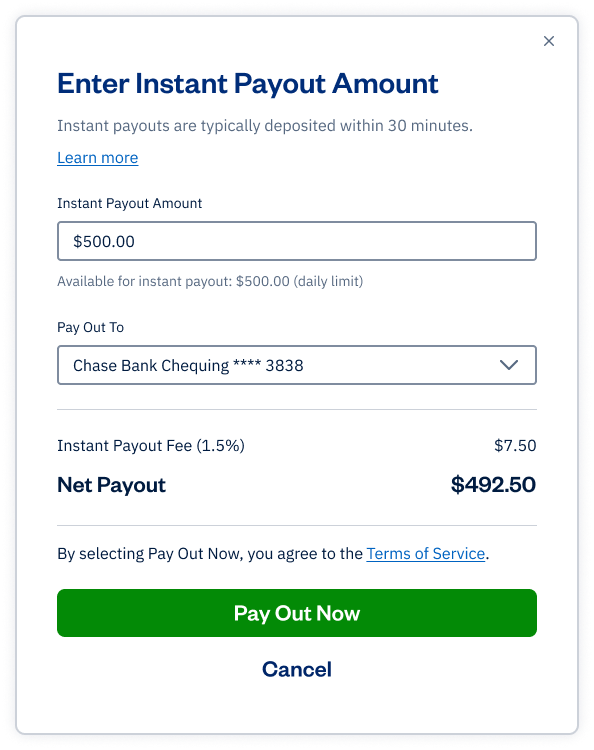

Transparent Fee Breakdown

Before confirming a payout, show users the exact breakdown: transaction amount, fee, and final amount they'll receive. No surprises.

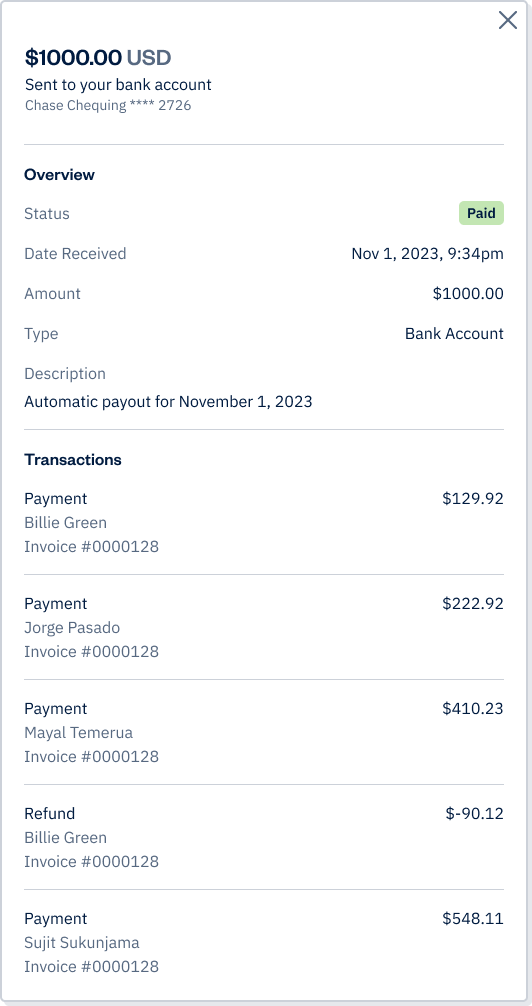

Historical Reference

Users need to review past transactions and fees. A payout history screen lets them audit and understand their payment patterns over time.

Key Design Decisions

Payment Status Visualization

The main screen shows a clear timeline or status view of where customer payments currently are: money pending deposit, money being processed, or money available for instant payout. This gives users immediate visibility into their cash position.

Fee Transparency Before Commitment

Before confirming an instant payout, users see a breakdown screen showing: total amount available, the instant payout fee, and the exact amount they'll receive. This prevents any surprises and builds confidence in the transaction.

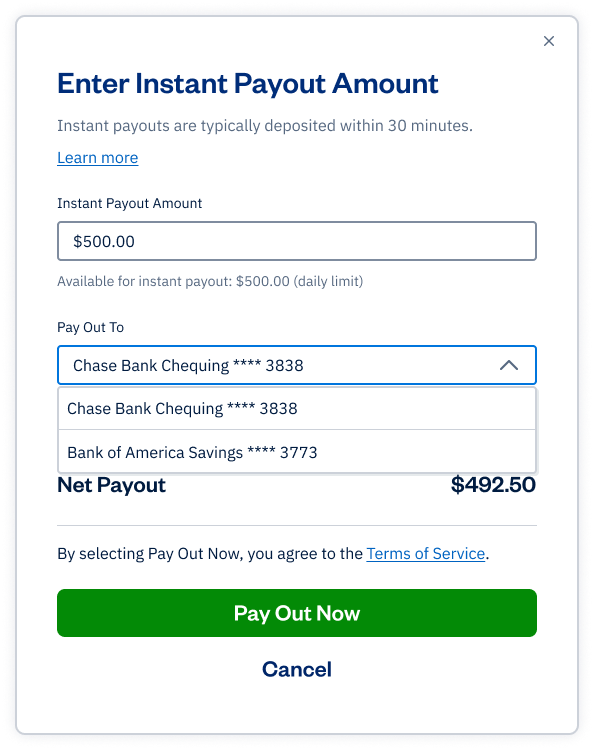

Connected Account Display

Show users exactly which bank account will receive the payout. This clarity prevents funds from going to the wrong place and gives users one more confirmation point before committing.

Payout History & Reference

A dedicated history screen lets users see all past payouts, the fees they paid, and the final amounts received. This serves as both a record and helps users understand their payout patterns and cost over time.

Impact & Outcomes

Instant Adoption

Users immediately recognized the value of instant cash access. The feature saw rapid adoption across the FreshBooks user base.

Low Support Burden

Very few support cases related to confusion about fees or surprise charges. The transparent design prevented issues before they happened.

Revenue Driver

Instant Payouts significantly contributed to monthly recurring revenue, becoming an effective business lever for the payments department.

User Flows & Mockups

Key Learnings

This project reinforced critical lessons about designing financial products:

- Transparency builds trust: When users understand exactly what's happening with their money and what they'll pay, they're more confident and less likely to need support.

- Show work visibly: The payment status visualization alone reduced anxiety. Knowing where money is in the pipeline is as valuable as the feature itself.

- Confirm at every step: With financial transactions, users need multiple confirmation points. Showing connected accounts, fees, and final amounts before committing prevents errors and regret.

- Iterate post-launch: We continued observing user behavior and iterating on edge cases and improvements after launch.